The fintech industry in Turkey has witnessed significant growth in recent years, spurred by increasing internet penetration, mobile device usage, and a young, tech-savvy population. The Turkish government has also played a pivotal role by implementing regulatory frameworks that encourage innovation while guaranteeing customer security. Digital payment solutions, peer-to-peer lending platforms, and robo-advisory services are some of the notable segments experiencing growth. Moreover, Istanbul is emerging as a fintech hub, attracting both local and international startups in Turkey. Collaboration between traditional banks and fintech companies has further accelerated the industry’s evolution. Nonetheless, challenges like cybersecurity concerns and the requirement for ceaseless development remain. Overall, the future of fintech in Turkey looks promising with its strategic positioning at the crossroads of Europe and Asia.

The following points help explain the significance of fintech businesses in Turkey:

- Economic Diversification: Fintech companies have played a crucial role in diversifying the Turkey economy, which traditionally relied heavily on sectors like tourism, textiles, and manufacturing. By offering innovative financial products and services, fintechs contribute to the city’s modern economic evolution.

- Boosting Financial Inclusion: Traditional banking systems might not always cater to every segment of the population. Fintech companies, especially those offering mobile wallets, peer-to-peer lending, or microfinance solutions, have expanded the reach of financial services to unbanked and underbanked segments of the population.

- Driving Innovation: The financial landscape in Turkey is thriving, with numerous entrepreneurs releasing cutting-edge products like AI-powered investment tools and online payment gateways. Consumers gain from this innovative environment, and Istanbul gains a competitive edge in the global fintech market.

- Supporting Infrastructure Development: The growth of fintech has necessitated infrastructure improvements, such as better internet connectivity and technological hubs or incubators. Turkey has seen an increase in co-working spaces, tech hubs, and incubator programs to support these startups.

- Attracting Investment: The fintech boom has caught the attention of international investors. Several Turkey-based fintech startups have secured funding rounds from global venture capital firms. This influx of capital boosts the overall economic health of the city.

- Employment Opportunities: As fintech firms grow, they also become significant employers in the city. From tech specialists to marketing professionals, these companies have created a multitude of job opportunities, contributing to the city’s overall employment rate.

- Enhancing Consumer Experience: Fintech companies provide consumers with more choices, better pricing, and improved convenience in financial transactions. Digital wallets, online lending platforms, robo-advisors, and insurtech solutions are just some examples of how fintech is enhancing the consumer experience in Turkey.

Fintech companies are playing a transformative role in Turkey‘s economic and financial landscape. They are not only shaping the way consumers and businesses interact with financial services but are also driving economic growth, innovation, and global collaborations for the city.

Following is the list of top 10 fintech companies in Turkey

As Turkey keeps on developing as a fintech center point, its mix of custom and advancement positions it to assume a vital part in molding the eventual fate of money, inside Turkey as well as across the worldwide fintech scene.

A Closer Look at the Top 10 Best Fintech Companies

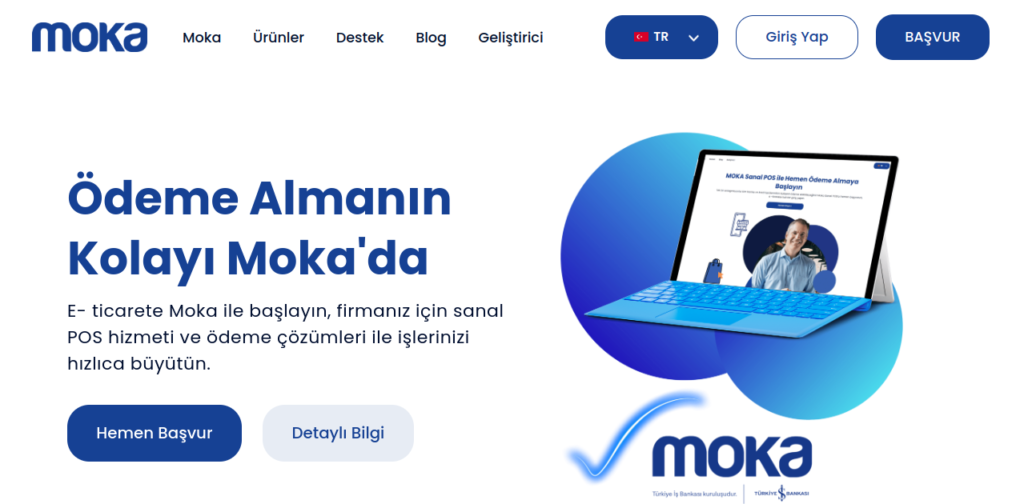

1) Moka

Company Overview

| Founded in | 2014 |

| Headquarters | Istanbul, Turkey |

| Size | 1 to 50 Employees |

| Industry | Financial Software |

| What they offered | Point of Sale (POS) Systems Payment Processing Inventory Management Sales Analytics Customer Relationship Management (CRM) Integration with Payment Gateways Mobile Payments Cloud-Based Solutions |

| Contact | info@moka.com |

Moka, a noticeable innovation organization settled in Istanbul, Turkey, has secured itself as a central member in the nation’s quickly developing tech scene. Established in 2014, Moka has in short order ascended to unmistakable quality through its imaginative arrangements in the field of retail location and installment frameworks.

Moka’s thorough set-up of items takes special care of organizations, everything being equal, offering productive and easy to understand answers for overseeing exchanges, stock, and client cooperations. Their POS programming flawlessly incorporates with different equipment, smoothing out the retail insight and improving functional effectiveness. Furthermore, Moka has created state of the art installment handling instruments that empower organizations to safely acknowledge an extensive variety of installment strategies.

The organization’s prosperity can be credited to its unfaltering obligation to innovative headway and consumer loyalty. Moka’s answers engage organizations to go with information driven choices, streamline their activities, and give an upgraded client experience. This has procured them a faithful and extending client base across different businesses, including retail, cordiality, and administrations.

Past its commitments to the business area, Moka has likewise gained ground in encouraging a culture of development inside Turkey’s tech local area. Through drives, associations, and joint efforts, the organization effectively adds to the development of the neighborhood innovation environment.

As Turkey’s economy keeps on advancing, Moka stays at the front line of driving innovative advancement, setting a model for hopeful business people and tech lovers the same.

2) Ininal

Company Overview

| Founded in | 2012 |

| Industry | Financial Software |

| What they offered | International Payments Gift Cards Cash Withdrawals Mobile Wallet Money Transfers Online Shopping Financial Inclusion |

| Contact | 0850 311 77 01 info@ininal.com |

| Website | www.ininal.com |

Moka, a noticeable innovation organization settled in Istanbul, Turkey, has secured itself as a central member in the nation’s quickly developing tech scene. Established in 2014, Moka has in short order ascended to unmistakable quality through its imaginative arrangements in the field of retail location and installment frameworks.

Moka’s thorough set-up of items takes special care of organizations, everything being equal, offering productive and easy to understand answers for overseeing exchanges, stock, and client cooperations. Their POS programming flawlessly incorporates with different equipment, smoothing out the retail insight and improving functional effectiveness. Furthermore, Moka has created state of the art installment handling instruments that empower organizations to safely acknowledge an extensive variety of installment strategies.

The organization’s prosperity can be credited to its unfaltering obligation to innovative headway and consumer loyalty. Moka’s answers engage organizations to go with information driven choices, streamline their activities, and give an upgraded client experience. This has procured them a faithful and extending client base across different businesses, including retail, cordiality, and administrations.

Past its commitments to the business area, Moka has likewise gained ground in encouraging a culture of development inside Turkey’s tech local area. Through drives, associations, and joint efforts, the organization effectively adds to the development of the neighborhood innovation environment.

As Turkey’s economy keeps on advancing, Moka stays at the front line of driving innovative advancement, setting a model for hopeful business people and tech lovers the same.

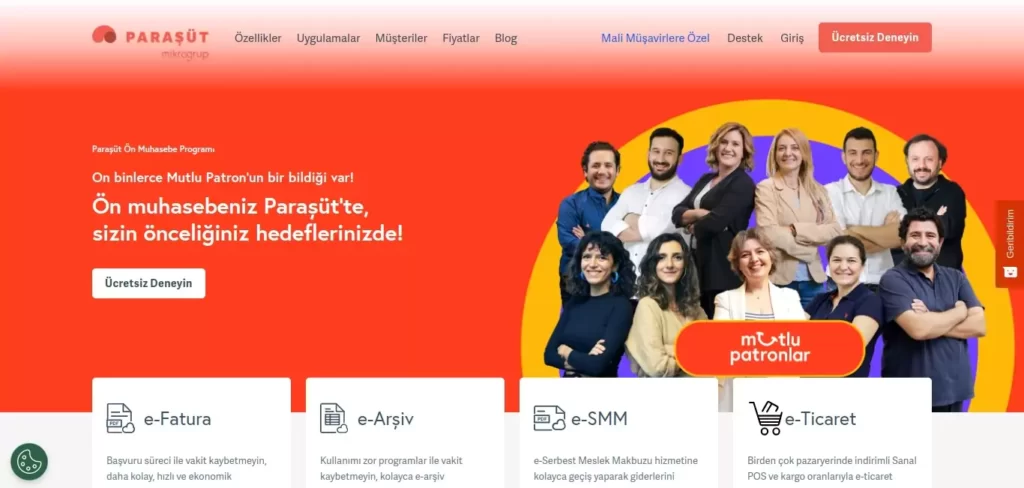

3) Paraşüt

Company Overview

| Founded in | 2013 |

| Industry | Financial Software |

| What they offered | Accounting Software Invoicing and Billing Expense Tracking Bank Integration Payroll Management Tax Compliance Customer and Supplier Management Integration with Third-Party Services |

| Contact | +90-212-963-0020 iletisim@parasut.com |

| Website | www.parasut.com |

Paraşüt is an unmistakable FinTech company situated in Turkey. Laid out in 2013, the organization has arisen as a pioneer in giving cloud-based bookkeeping and monetary administration answers for organizations of different sizes, assisting them with smoothing out their monetary tasks.

Paraşüt’s easy to understand stage offers a scope of instruments, including invoicing, cost following, finance the executives, and duty estimation. By digitizing and computerizing these cycles, Paraşüt engages business visionaries and entrepreneurs to zero in more on center activities and less on authoritative errands.

The organization has earned huge consideration for its imaginative methodology, adding to the modernization of Turkey’s business scene. Its administrations play had a critical impact in encouraging business venture and supporting the development of little and Small medium enterprise (SMEs) in the country.

With a client driven way of thinking, Paraşüt has developed a faithful client base, which incorporates specialists, new businesses, and laid out ventures. The organization’s obligation to keeping up to date with mechanical headways and its devotion to working on monetary administration have cemented its situation as a forerunner in the Turkish FinTech area.

Paraşüt’s process mirrors the extraordinary capability of innovation in reshaping conventional monetary works on, empowering organizations to flourish in an undeniably advanced world.

4) Iyzico

Company Overview

| Founded in | 2013 |

| Industry | Financial Technology Company |

| What they offered | Online Payment Gateway Mobile Payment Solutions One-Click Checkout Subscription and Recurring Payments Multi-Currency Support Fraud Prevention Customizable Payment Pages |

| Contact | +90-216-599-0100 destek@iyzico.com |

| Website | www.iyzico.com |

Iyzico is a conspicuous monetary innovation (fintech) agency settled in Istanbul, Turkey. Laid out in 2013, the organization has practical experience in giving imaginative installment arrangements and administrations, taking care of the advancing necessities of organizations and purchasers in the computerized period. As of my insight cutoff in September 2021, Iyzico plays had a crucial impact in changing the scene of online installments in Turkey.

The organization offers an exhaustive set-up of installment arrangements, including on the web and portable installment handling, membership charging, and secure installment passages. Utilizing trend setting innovation and an easy to use interface, Iyzico enables organizations, all things considered, to consistently acknowledge installments web based, improving client encounters and empowering development in the online business area.

Iyzico’s prosperity can be credited to its obligation to security, dependability, and client centricity. By sticking to severe industry principles and utilizing state of the art encryption and extortion avoidance instruments, Iyzico guarantees that exchanges directed through its foundation are secure and reliable.

Besides, Iyzico’s effect reaches out past its innovative contributions; it has added to the modernization of Turkey’s monetary foundation and the development of the advanced economy. The organization’s imaginative methodology, nimbleness, and devotion to further developing the installment scene have situated it as a central member in Turkey’s fintech environment, cultivating monetary development and working with monetary consideration.

5) Norma

Company Overview

| Founded in | 2020 |

| Industry | Financial Services |

| What they offered | Free Corporate Account Free Norma Card Money Transfer Buy & Sell Currency Easy Account Tracking Invoice Tracking e-SMM and e-Signature e-Transformation Services |

| Contact | 08502117373 destek@norma.co |

| Website | www.norma.co |

Norma.co knows that the banking, money and bookkeeping needs of business visionaries, independently employed or consultants are normal and they have various requests from enormous organizations. Norma was planned as a money stage that answers all necessities from a solitary stage and works with crafted by its clients.

Its will likely set out the freedom for independently employed business visionaries to follow their fantasies and spotlight on their business. Every one of their clients will find Norma with them at whatever point they feel alone in the fields of advanced banking, money and bookkeeping. It is blissful and pleased to help the fantasies of all business visionaries with all endlessly benefits at Norma, which they have created with the saying of a confidential money stage.

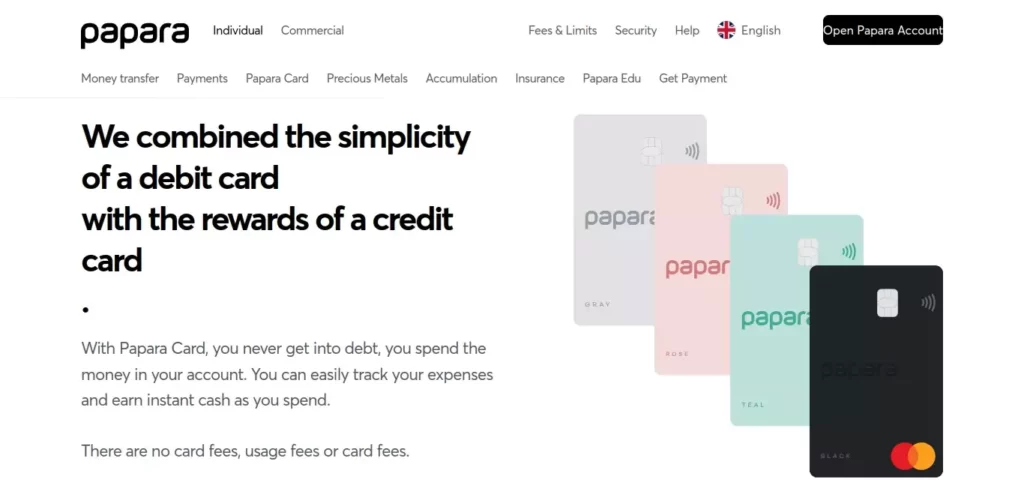

6) Papara

Company Overview

| Founded in | 2016 |

| Industry | Financial Technology |

| What they offered | Currency Exchange Providing Prepaid Mastercard Digital Wallet & Virtual Cards Cash Withdrawals Budgeting Tools |

| Contact | 0850 340 0 340 support@papara.com |

| Website | www.papara.com |

Papara is a conspicuous financial technology situated in Turkey that offers creative computerized installment answers for people and organizations. Established in 2016 by Ahmed Karslı and Erinc Yılmaz, Papara has quickly earned respect for its easy to use and get monetary administrations. The organization’s essential spotlight is on making a consistent and proficient installment biological system, taking care of the developing necessities of current customers.

Papara gives a scope of administrations, including pre-loaded check cards, computerized wallets, and shared cash moves. Its foundation empowers clients to handily deal with their funds, make online buys, cover bills, and send cash to loved ones. The organization’s obligation to security is obvious through its severe measures, like two-factor confirmation and high level encryption conventions, guaranteeing the assurance of client information and exchanges.

Papara has acquired significant fame in Turkey because of its accommodation, straightforwardness, and the shortfall of customary financial imperatives. It has laid out essential organizations with different vendors, internet business stages, and specialist co-ops, growing its scope and effect on the Turkish monetary scene.

7) Manibux

Company Overview

| Founded in | 2016 |

| Industry | Fintech |

| What they offered | Mobile App (Android & iOS) Financial Education Tool Secure Money Card |

| Contact | +90 216 706 22 66 destek@manibux.com |

| Website | manibux.com |

ManiBux, a dynamic and creative company settled in the clamoring city of Istanbul, Turkey, has quickly arisen as a noticeable player in the tech business. That company has collected consideration for its state of the art arrangements and ground breaking approach, situating itself as a center point for mechanical headway.

With its different scope of contributions, ManiBux fundamentally affects different areas. The company has practical experience in taking special care of the advancing requirements of companies and people the same.

The organization’s prosperity can be credited to its obligation to development. ManiBux’s innovative work group, contained probably the most brilliant personalities in the business, reliably pushes limits to foster advancement arrangements. By cultivating a culture of imagination and investigation, ManiBux guarantees that it stays at the cutting edge of mechanical headways.

Past its mechanical ability, ManiBux is well established in its obligation to corporate social obligation. The organization effectively participates in local area outreach programs, supporting (mention a couple of drives or causes). This devotion to offering back features ManiBux’s comprehensive way to deal with business, showing its job as a capable corporate resident.

In a quickly developing computerized scene, ManiBux proceeds to adjust and flourish. Its presence in Istanbul, a city crossing over Europe and Asia, fills in as a competitive edge, permitting the organization to take advantage of a different ability pool and lay out worldwide associations.

All in all, ManiBux’s excursion from its commencement to its ongoing remaining as a development force to be reckoned with in Turkey, is a demonstration of its steadfast obligation to pushing the limits of innovation. Through its historic arrangements, commitment to development, and local area centered drives, ManiBux is ready to shape the eventual fate of tech in Turkey as well as on a more extensive worldwide scale.

8) VeriPark

Company Overview

| Founded in | 2016 |

| Industry | Fintech |

| What they offered | CRM Solutions Digital Banking Platforms Customer Onboarding Omnichannel Engagement Loan Origination Wealth Management |

| Contact | +90 216 706 22 66 destek@manibux.com |

| Website | manibux.com |

VeriPark works cooperatively with clients to foster imaginative innovation methodologies and arrangements, contacting a large number of individuals consistently and rejuvenating the commitment of computerized change. VeriPark is a dynamic and imaginative fintech organization situated in Istanbul, Turkey, that has some expertise in giving state of the art computerized banking and client experience answers for monetary establishments around the world. Established in 1998, VeriPark has arisen as a forerunner in the fintech scene, engaging banks to upgrade their computerized contributions and convey consistent encounters to their clients.

At the core of VeriPark’s central goal is the objective of changing conventional financial practices into current, client driven ventures. The organization’s answers envelop a great many administrations, including client relationship the board (CRM), credit beginning, computerized financial stages, and client commitment devices. VeriPark’s items are intended to smooth out activities, help productivity, and raise consumer loyalty in an undeniably computerized financial climate. VeriPark’s obligation to development is exemplified by its joining of arising advances like computerized reasoning (artificial intelligence), AI, and information examination into its answers. By outfitting the force of these advances, VeriPark empowers banks to investigate client conduct, anticipate inclinations, and proposition applicable items and administrations.

9) Birevim

Company Overview

| Founded in | 2016 |

| Industry | Fintech |

| What they offered | Monthly Installment Plans Savings and Investment Accounts Gold Accumulation Plans Personal Finance Consultation Shariah Compliance |

| Contact | +90 444 23 53 iletisim@birevim.com.tr |

| Website | www.birevim.com |

Birevim, the modeler of the “Saving Together Money” technique, in which reserve funds are utilized as a monetary instrument, was established in 2016. Since the day it was established, it keeps on creating arrangements inside the structure of the human-focused social money approach it has created to meet the lodging, work environment and vehicle needs of the savers, which it characterizes as individual business people. BIREVİM, which has helped 1 out of each and every 3 savers in the area address their issues, has prevailed with regards to turning into the train brand of the Reserve funds Money area in a brief time frame.

BIREVİM expects to quickly build the quantity of savers in our country with the “Saving Together Money” strategy, and to carry individual reserve funds into the nation’s economy, particularly by consolidating the singular saving influence of our residents in the low and center pay bunch in a huge manner, with an investment funds and resource based monetary model that did not depend on getting.

One of the key highlights that separates Birevim is its attention on participatory possession, an Islamic monetary idea that sticks to Sharia standards. Birevim empowers people to possess a home without including customary interest-based loaning. All things considered, the organization utilizes a model where clients and Birevim mutually put resources into properties, and after some time, the clients get possession through ordinary installments. This approach lines up with Islamic monetary morals that restrict the charging or acquiring of interest.

10) Finartz

Company Overview

| Founded in | 2016 |

| Industry | Fintech Studio |

| What they offered | Fraud Prevention Payment Solutions Financial Software Development Security and Compliance Cloud-Based Solutions Digital Transformation |

| Contact | +90 (850) 840 21 34 info@finartz.com |

| Website | finartz.com |

Finartz is known for its skill in regions like installment frameworks, advanced banking, and blockchain innovation. The organization’s central goal spins around assisting monetary foundations with embracing mechanical progressions to upgrade their activities, further develop client encounters, and remain cutthroat in an advancing industry.

One of the striking items created by Finartz is “Payfull,” an installment passage arrangement that engages web based business organizations to safely deal with online installments and oversee exchanges. Payfull offers an easy to use stage with different installment choices, misrepresentation counteraction systems, and highlights intended to enhance the installment interaction for the two organizations and their clients.

Notwithstanding its work on installments, Finartz has likewise exhibited areas of strength for an in blockchain innovation. The organization has investigated the capability of blockchain for making secure and straightforward monetary environments, with an emphasis on applications like computerized character check and store network finance.

The studio’s obligation to advancement and its cooperative methodology deserve it acknowledgment inside the Turkish fintech local area and then some. Finartz has taken part in different industry occasions, hackathons, and drives, adding to the development of the fintech environment in Turkey.